- Join 100+ financiers saving millions

Turn weeks of QC into hours

AI-native QC that clears defect-free packets 5x faster

while cutting per-loan cost by 80%

The difference is staggering

See why leading solar financiers are switching to WattPay

WattPay = single, API-first layer between installers, borrowers & funders

Our comprehensive platform automates QC, policy checks and data flows to slash per-loan cost and turnaround time.

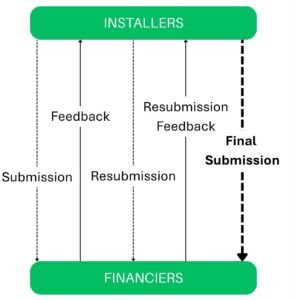

WattPay turns back-and-forth submissions into a single, seamless pass

Eliminate lengthy QC cycles and reduce resubmissions by 70%

Before

After

AI-native platform slashes solar-loan processing from days to hours

WattPay delivers immediate, measurable operational improvements and financial benefits.

Reduced Funding Timeline

Faster QC Processing

Fewer Defects

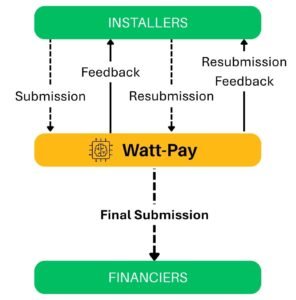

Current QC model strains margins as volumes rebound

Historical & projected US residential TPO, loan and cash-sales outlook, 2020-2030

Lenders still review IDs, income docs, system specs by hand; approvals take 5–10 days, delaying funding.

High defect rate drives re-work cycles that eat QC budgets and drag on cash flow.

Data spread across emails and spreadsheets → poor visibility for installers & homeowners; capital sits idle during long QC cycles.

- 500+ solar financiers trust WattPay

Don't let slow processing

cost you millions

Every day you wait is money left on the table. Join the solar finance revolution and start saving today.

- No setup fees • 30-day money-back guarantee • SOC 2 compliant

©2024 – Wattmonk Technologies